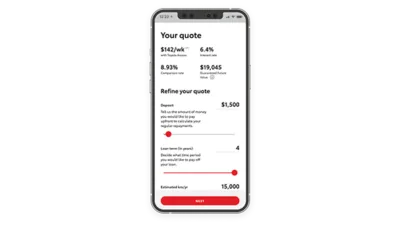

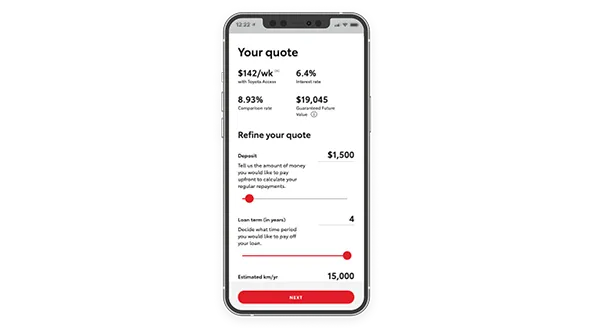

3 minute quote

We calculate your interest rate, comparison rate and repayments – tailored to your unique financial circumstances.

Same interest rate across all Dealers

No matter which Dealership you visit across Australia, you will get the same Toyota Personalised Repayments[F6] and interest rate.

Estimated repayments across the entire range

Once you have your personalised repayment, you can then compare vehicles across the entire Toyota range.

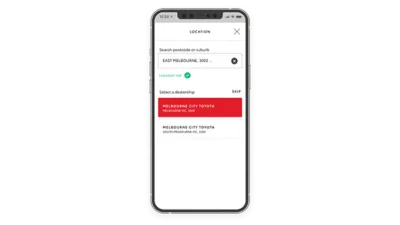

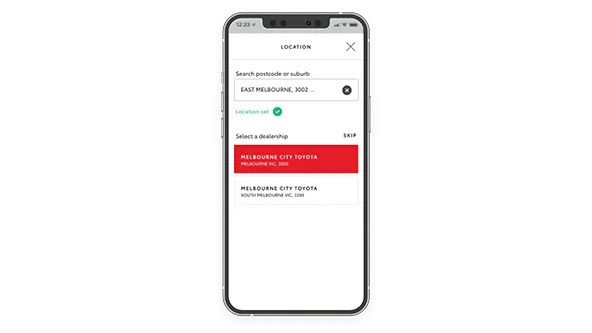

Find a dealer

Knowing your preferred Dealer means we can provide a more accurate quote, at a location that suits you.

Select a vehicle

Choose your ideal Toyota from your preferred Dealer’s website. You can compare other vehicles later.

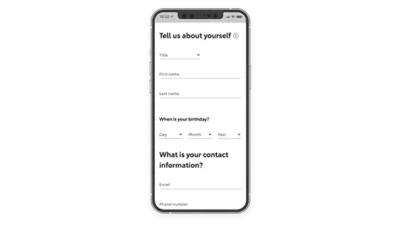

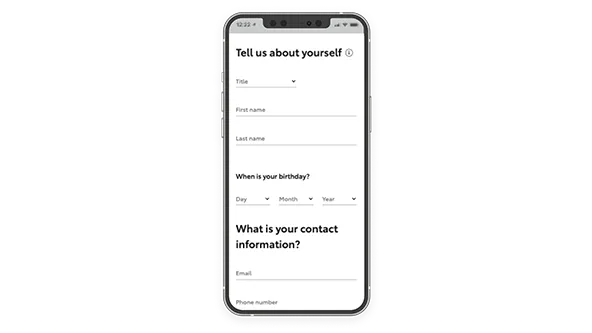

Complete the form

Enter your details on our safe and secure portal to calculate your Toyota Personalised Repayment[F6], interest rate and repayment terms. Remember, doing so does not impact your credit score.

Recalculate

Once we’ve calculated your Toyota Personalised Repayment[F6], you’re free to change vehicles and grades to see how it affects your personalised repayments.

| Checklist | Reason |

| Australian driver’s licence | To complete your quote, we’ll need your licence number to validate your eligibility to drive in Australia. |

| Current contact information | Your name, address and date of birth help us verify who you are. |

| Personal details | A few personal details such as your living arrangements help us calculate your quote. |

| Credit check | Unlike other quote providers, this quote will not affect your credit score.** |

Personalised repayments

We calculate your Toyota Personalised Repayments[F6] using your personal information and our sophisticated, safe and secure software.

Total transparency

No matter who you are or where you live in Australia, we’ll use the same criteria to calculate your Toyota Personalised Repayments[F6].

Tried and trusted

We’ve helped more than 1 million Australians get behind the wheel of their dream Toyota. We can help you too.

Toyota Access Loan

A Toyota Access Loan can offer you lower monthly repayments[F9] than a regular car loan, a Guaranteed Future Value[F2] and a loan term between 1 and 4 years. At the end of your loan, your options are flexible, helping you stay agile and in control.

Toyota Fixed Rate Loan

Our Fixed Rate Car Loan puts you in control. Decide on your deposit amount or decide not to have one at all. You also get to choose the length of your loan – anywhere between 1 and 7 years – and how often your repayments are due. And best of all, at the end of the loan, the vehicle is yours to keep.

Frequently Asked Questions

What are Toyota Personalised Repayments?

Toyota Personalised Repayments[F6] are based on your interest rate and other relevant criteria including the amount financed, deposit, loan term and kilometres. Your interest rate is a rate that’s tailored to your financial circumstances so it is specific to you.

Instead of taking a one-size-fits all approach, we use your credit score and other relevant criteria to calculate a rate that’s right for you. No matter who you are or where in Australia you live, the same transparent and trusted process applies.

Toyota Personalised Repayments[F6] are based on your interest rate and other relevant criteria including the amount financed, deposit, loan term and kilometres. Your interest rate is a rate that’s tailored to your financial circumstances so it is specific to you.

Instead of taking a one-size-fits all approach, we use your credit score and other relevant criteria to calculate a rate that’s right for you. No matter who you are or where in Australia you live, the same transparent and trusted process applies.

Toyota Personalised Repayments[F6] are based on your interest rate and other relevant criteria including the amount financed, deposit, loan term and kilometres. Your interest rate is a rate that’s tailored to your financial circumstances so it is specific to you.

Instead of taking a one-size-fits all approach, we use your credit score and other relevant criteria to calculate a rate that’s right for you. No matter who you are or where in Australia you live, the same transparent and trusted process applies.

Toyota Personalised Repayments[F6] are based on your interest rate and other relevant criteria including the amount financed, deposit, loan term and kilometres. Your interest rate is a rate that’s tailored to your financial circumstances so it is specific to you.

Instead of taking a one-size-fits all approach, we use your credit score and other relevant criteria to calculate a rate that’s right for you. No matter who you are or where in Australia you live, the same transparent and trusted process applies.

Why does Toyota Finance rely on software to calculate my rate?

Our goal is to give you a rate that’s transparent and tailored to your financial circumstances. We have a smart algorithm that’s designed to calculate your rate, based on your individual credit score and other financial criteria determined by us.

Our goal is to give you a rate that’s transparent and tailored to your financial circumstances. We have a smart algorithm that’s designed to calculate your rate, based on your individual credit score and other financial criteria determined by us.

Our goal is to give you a rate that’s transparent and tailored to your financial circumstances. We have a smart algorithm that’s designed to calculate your rate, based on your individual credit score and other financial criteria determined by us.

Our goal is to give you a rate that’s transparent and tailored to your financial circumstances. We have a smart algorithm that’s designed to calculate your rate, based on your individual credit score and other financial criteria determined by us.

What is a credit score?

A credit score is a single number, usually between 300 and 850, that enables financial institutions to get a sense of your credit history and to work out whether you’re a viable person to lend money to.

A credit score is a single number, usually between 300 and 850, that enables financial institutions to get a sense of your credit history and to work out whether you’re a viable person to lend money to.

A credit score is a single number, usually between 300 and 850, that enables financial institutions to get a sense of your credit history and to work out whether you’re a viable person to lend money to.

A credit score is a single number, usually between 300 and 850, that enables financial institutions to get a sense of your credit history and to work out whether you’re a viable person to lend money to.

Get your Toyota Personalised Repayments[F6] today

Disclaimers

[F2]The GFV is the minimum value of your Toyota at the end of your finance contract, as determined by Toyota Finance. If you decide to return your car to Toyota Finance at the end of your term, Toyota Finance will pay you the agreed GFV, which will be put against your final payment subject to fair wear and tear conditions and agreed kilometres being met. Terms, conditions, fees, charges & lending criteria apply. Approved applicants only. Toyota Finance is a division of Toyota Finance Australia Limited ABN 48 002 435 181, AFSL and Australian Credit Licence 392536.

[F6]Approved applicants only. Terms and conditions apply. Toyota Finance is a division of Toyota Finance Australia Limited ABN 48 002 435 181, AFSL and Australian Credit Licence 392536.

[F9]Lower monthly repayments compared to a similar term with no Guaranteed Future Value (GFV) or equivalent balloon final payment. Total interest charges will be higher if a GFV or balloon final payment is selected.

[F2]The GFV is the minimum value of your Toyota at the end of your finance contract, as determined by Toyota Finance. If you decide to return your car to Toyota Finance at the end of your term, Toyota Finance will pay you the agreed GFV, which will be put against your final payment subject to fair wear and tear conditions and agreed kilometres being met. Terms, conditions, fees, charges & lending criteria apply. Approved applicants only. Toyota Finance is a division of Toyota Finance Australia Limited ABN 48 002 435 181, AFSL and Australian Credit Licence 392536.

[F6]Approved applicants only. Terms and conditions apply. Toyota Finance is a division of Toyota Finance Australia Limited ABN 48 002 435 181, AFSL and Australian Credit Licence 392536.

[F9]Lower monthly repayments compared to a similar term with no Guaranteed Future Value (GFV) or equivalent balloon final payment. Total interest charges will be higher if a GFV or balloon final payment is selected.

[F2]The GFV is the minimum value of your Toyota at the end of your finance contract, as determined by Toyota Finance. If you decide to return your car to Toyota Finance at the end of your term, Toyota Finance will pay you the agreed GFV, which will be put against your final payment subject to fair wear and tear conditions and agreed kilometres being met. Terms, conditions, fees, charges & lending criteria apply. Approved applicants only. Toyota Finance is a division of Toyota Finance Australia Limited ABN 48 002 435 181, AFSL and Australian Credit Licence 392536.

[F6]Approved applicants only. Terms and conditions apply. Toyota Finance is a division of Toyota Finance Australia Limited ABN 48 002 435 181, AFSL and Australian Credit Licence 392536.

[F9]Lower monthly repayments compared to a similar term with no Guaranteed Future Value (GFV) or equivalent balloon final payment. Total interest charges will be higher if a GFV or balloon final payment is selected.

Quick Links

- Home

- New Toyota Vehicles

- Toyota Warranty Advantage

- myToyota Connect

- Toyota Certified Pre-Owned Vehicles

- Demo Vehicles

- All Pre-Owned Stock

- Trade In Your Car

- Instant Valuation Tool

- myToyota Connect

- National Offers

- Dealer Specials

- Service to Win a RAV4*

- Finance

- Full-Service Lease

- Used Car Finance

- Finance For Farmers

- Toyota Personalised Rate Page

- Toyota Car Insurance

- Toyota Access

- Toyota Service

- Online Service Booking

- Warranty Advantage

- Toyota Parts

- Toyota Accessories

- Latest Toyota News

- About Us

- Careers

- Reciprocal Sponsorship

- FAQs

- Environmental Policy

- Complaint Handling Process

- Contact Us